Agency Conflicts Between Managers and Shareholders

From stock market news to jobs and real estate it can all be found here. Welcome to the Continental Western Group E-Pay Express online bill payment services website which provides bill payment options and services such website options and services are individually and collectively referred to herein as the E-Pay Express Services available to customers of the Continental Western Group an operating.

Principal Agent Problem Overview Examples And Solutions

Questions about superannuation funds.

. Gil Thorp comic strip welcomes new author Henry Barajas. Concurrent conflicts of interest can arise from the lawyers responsibilities to another client a former client or a third person or from the lawyers own interests. Tribune Content Agency builds audience Our content engages millions of readers in 75 countries every day.

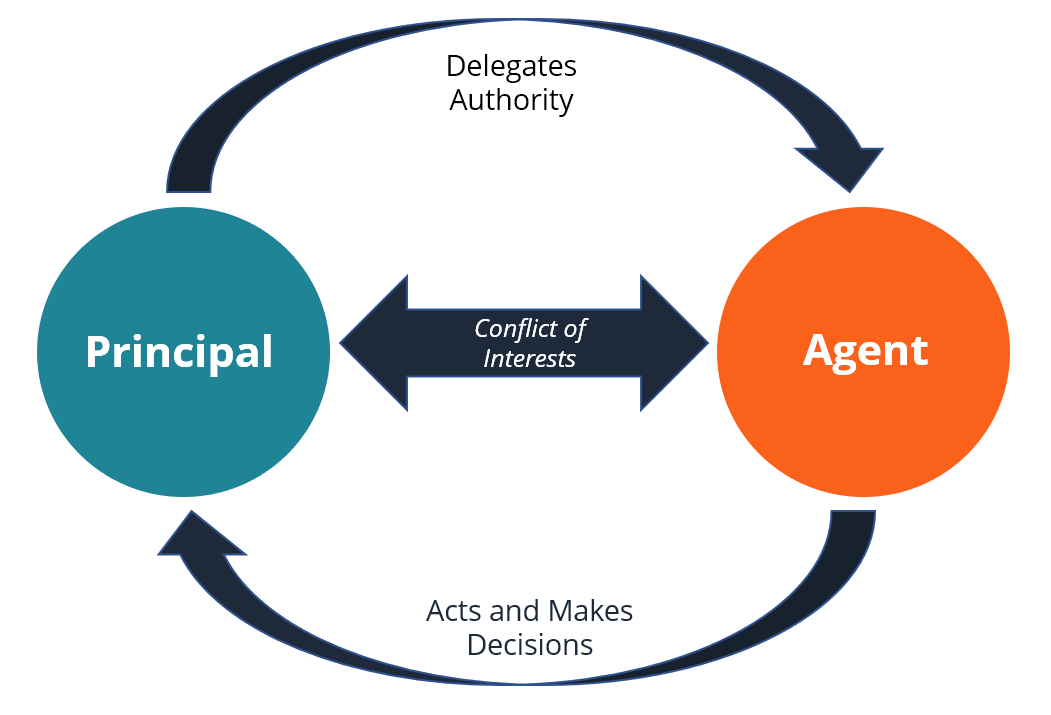

The principalagent problem refers to the conflict in interests and priorities that arises when one person or entity the agent take actions on behalf of another person or entity the principal. The agency problem is a conflict of interest inherent in any relationship where one party is expected to act in anothers best interests. The problem worsens in situations when there is a greater discrepancy of interests and information asymmetry between the principal and agent as well as when the principal lacks.

TERMS OF SERVICE AGREEMENT. Cross-agency process for retirement income stream products. Technologys news site of record.

Tribune Content Agency is pleased to announce Patti Varol as editor of. Forms for superannuation entities. The essential tech news of the moment.

Its best practice for the agent to make. Payment of dividends can help reduce the agency conflicts between managers and shareholders but it also can worsen conflicts of interest between shareholders and debtholders. An agency problem is a conflict of interest between an agent and a principal where an agent is a person or group of people who performs a task on behalf of someone else the principal.

Agency theory the anal-ysis of such conflicts is now a major part of the economics literature. A problem arising from the conflict of interested created by the separation of management from ownership the stockholders in a publicly owned company. For conflicts of interest involving prospective clients see Rule 118.

The payout of cash to shareholders creates major conflicts that have received little attention Payouts to shareholders reduce the resources under managers control thereby reducing man-agers power and making it more likely they will incur the monitoring of the capital markets. Get breaking Finance news and the latest business articles from AOL. OpenClose Menu Non regulated industries.

Welcome to the team. For specific Rules regarding certain concurrent conflicts of interest see Rule 18. Empirically several factors appear to influence dividend policy including investment opportunities for the company the volatility expected in its future earnings financial flexibility tax considerations.

For former client conflicts of interest see Rule 19. A conflict of interest occurs when one party doesnt fulfill contractual obligations in favor of their own personal or professional interests. In corporate finance the agency problem.

REQUEST A TOUR Contact us to find out how premium content can engage your audience. Registered financial corporations standards. Agency Cost Of Debt.

Non-regulated entities reporting to APRA.

Agency Problem And Corporate Governance Solution Circle Of Business

Agency Cost Financial Analysis Financial Management Finance Meaning

Pdf Do Agency Conflicts Between Managers And Shareholders Affect Corporate Risk Management And Financial Performance Of Saudi Firms

0 Response to "Agency Conflicts Between Managers and Shareholders"

Post a Comment